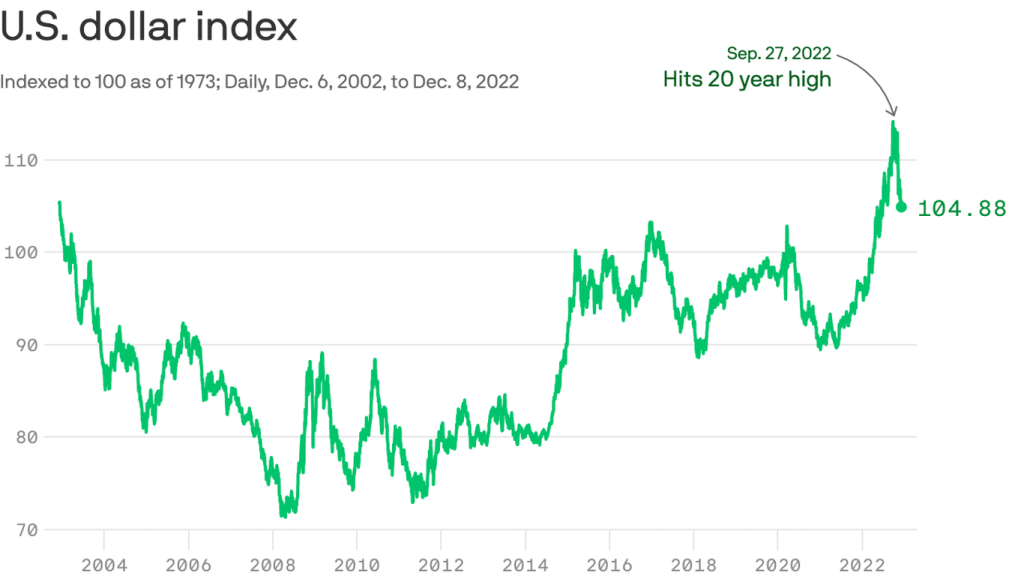

Data: FactSet; Chart: Axios Visuals

After hitting a 20-year high this fall, the dollar is now weakening fast.

Driving the news: The U.S. dollar index — which tracks the buck against a basket of six other major currencies — is down more than 8% from its September peak.

That’s the most the dollar has fallen in a roughly 10-week time frame in over a decade.

Why it matters: The drop suggests markets now think the worst of the recent inflation is over, and therefore the Fed can soon start to slow down or even stop its rate-hiking program.

The big picture: Like pretty much everything in the markets this year, the dollar’s rally — it was up nearly 19% at one point — is tied to the aggressive interest rate hikes the Fed imposed to try to rein in inflation.

Currencies fluctuate for a bunch of reasons. But some of the most important drivers are known on Wall Street as “interest rate differentials.” These…

Read more…